An exploration of the importance of the future risk manager in understanding the impact of risk leadership in a VUCA world

The VUCA experience and IRM Agenda 2025

Exploring the VUCA Concept in Risk Leadership turned out to be an exciting and an eye opener for the Risk Managers attending The Future Risk Manager - An IRM South Africa Regional Group Conference on 4 October 2018.

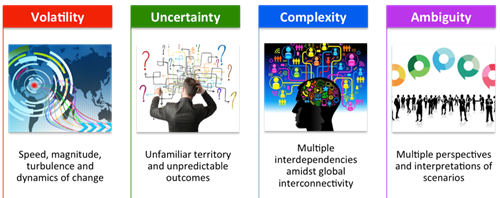

The term VUCA (Volatility, Uncertainty, Complexity ‘Ambiguity) is explained in figure 1 below.

VUCA World: volatile, uncertain, complex and ambiguous

FIGURE 1 - Source - Purple Growth Consulting. Training. Coaching 4 October 2018

Leaders in the VUCA World are faced with massive challenges such as continuous change in legislation and compliance requirements, longevity, big data, technology (Internet of Things, robotics), globalisation, economic recession, depleting resource, corruption, state capture etc. This requires them to think fast and make decisions on the spot in order to keep up with the demands of VUCA World. The Leaders need to be able to connect the dots, be technology smart and possess unique skills and competences such as risk leadership that will enable fast thinking and decision making process.

Looking the IRM Risk Agenda 2025 Report, it also emphasise the top five risk areas which may impact organisations of which leaders should be aware of and be able to take risk leadership in order to build effective risk resilience strategies around these areas. The top five risk areas are: Technological change, economic volatility / financial instability, geopolitical volatility, climate change and longevity.

This requires that 21st century leaders must be able to make decisions faster, process huge amounts of information and be more agile to respond to the unique challenges and opportunities of today's world. Horizon scanning and scenario planning are one of the tools that will assist leaders to keep up with these new demands.

Ethical behaviour in providing assurance on governance, risk and compliance matters.

The message is: “We can no longer turn a blind eye as risk managers when corrupt activities happens around us in the workplace.” Individuals can be held liable by law when found to be knowingly ignored reporting on corrupt activities.

Business ethics requires that risk managers must know and understand the laws that need to be complied with, the values on how to do the job and the policies and procedures that indicate how to do things.

Risk managers are expected to assist leaders to build an ethical culture in the organisation by identifying corruption risk areas, create reporting structures, provide training to the organisation as the whole including third parties and maintain ongoing awareness.

Combine assurance and coordinated efforts from governance, risk and compliance should be encouraged in the organization in creating the risk free environment

The future risk manager

The facilitated discussion resulted in the following attributes for the future risk manager:

- A risk manager who is skilled and competent enough to understanding the impact of change in the VUCA World and trending risk areas as depicted in the Risk Agenda Report 2025

- Risk manager should report to the top decision makers in the organisation

- A good communicator and assertive individual who is not afraid to take calculated risks

- A risk manager who is an influencer of strategic decision making process in the boardroom and organisation on the whole

- Who no longer ticks the boxes but is part of the solution and problem solving in the organisation

- Who is innovative, creative, looks at the opportunities and advise accordingly

- Who understand the laws and regulations that govern the organisation and ensure compliance at all times

- Being a risk manager who epitomizes the highest ethical behaviour and integrity and leads by example

- The future risk manager must understand the business environment in which the organization operates (internal and external environment)

- Must apply tools such as horizon scanning and scenario planning in order to assist the organisation to predict the future risk areas and be able to build effective resilience strategies

- Acquiring skills, qualification, knowledge and technical competence become a priority for the future risk manager

- Education, training and Continuous Professional Development (CPD) must be ongoing

- Obtaining knowledge and education on big data, technology, IT developments within one’s industry and organisation is a must.

In conclusion: The future risk manager need to do an introspection about his or her role and ethical behaviour in assisting the leaders and the organisations to cope with VUCA world’s demands and the risk trends as highlighted in Risk Agenda 2025.

Continuous sharpening of the saw is the key for success and dealing with rapid change for both leaders and risk managers.

Zanele Makhubo, Chair of the IRM South Africa Regional Group

Director: Enterprise Risk Management

Gauteng Department of Human Settlement